Juniper Research analysts have termed 2015/16 “watershed years” for HCE (Host Card Emulation) in terms of commercial service rollouts. Indeed, at least 194 banks introduced such services by the end of 2016, while Juniper expects PayPal to “rapidly deploy” a portfolio of contactless payment and loyalty solutions.

Juniper analysts also concluded that Apple Pay, along with the alternative wallets that have followed in its wake, are set to establish themselves as the primary contactless mechanisms of choice in the U.S.

“We believe that as contactless usage gains traction and consumers/merchants recognize the speed and convenience it offers, then, as in European markets, there will be a further and significant increase in availability at the point-of-sale,” said Juniper analyst Nitin Bhas.

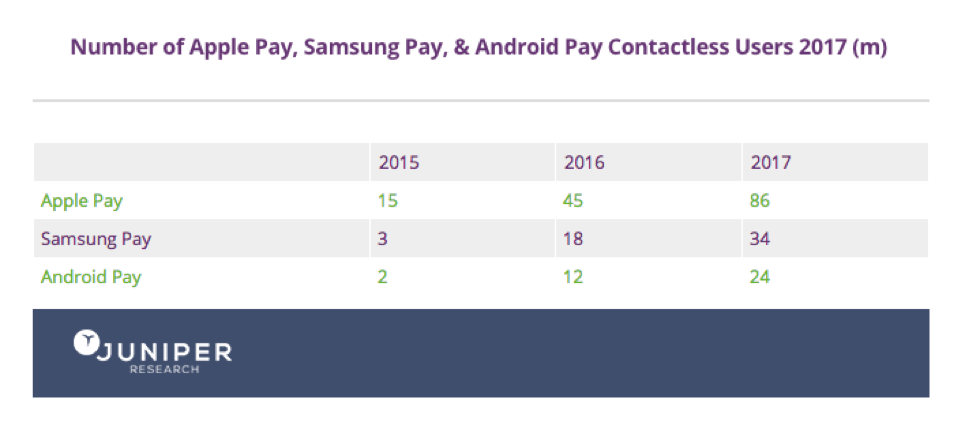

To be sure, Juniper Research estimates that the number of OEM-Pay contactless users, including Apple Pay, Samsung Pay and Android Pay, will exceed 100 million for the first time during 1H-2017, before surpassing 150 million by the end of this year.

In the meantime, the combined market share of Apple, Samsung and Google (via Android Pay), increased from 20% in 2015 to 41% in 2016, as a proportion of total mobile contactless payment users. Juniper predicts this figure will rise to 56% by 2021, as the trio’s combined user base exceeds 500 million.

In related news, Statista sees mobile payments growing at a rate of 52% through to 2021, resulting in a transaction value of $866 billion in 2021. According to Statista, China and the U.S. lead the way in terms of user penetration, although with a 28% user penetration rate, the U.S. is expected to overtake China in 2019. While concerns over personal data and fraud remain barriers for more significant adoption, 44% of those recently surveyed by Statista have expressed interest in paying for restaurant and cafés visits via smartphone.

Meanwhile, the 2016 North America Consumer Digital Payments Survey (cited by The Motley Fool via BusinessInsider) indicates that while consumers still default to traditional payments for now, many report that they expect to make more digital payments by 2020. As Danny Vena of The Motley Fool explains, there are at least several key trends at play to drive further mobile payment adoption.

“56% of consumers are aware of the technology and plan to use it in coming years. Millennials (those the report defines as being between the ages of 18 and 34) and mass affluents (those consumers with annual income of $100,000 or more after taxes) are pioneering the change to digital payments, with 35% of these groups regularly using their mobile phone to make online payments,” Vena added.

Interested in learning more about HCE and mobile payments? You can check out our eBook on the subject below.