Rambus and eftpos support Apple Pay transactions in Australia

Rambus has teamed up with domestic debit network eftpos to help provide secure transactions for Apple Pay users in Australia. Through integration with Rambus’ Token Service Provider (TSP) technology, eftpos is able to support Apple Pay security and hardware features to maintain the privacy of consumer data. Put simply, tokenization minimizes the risk of fraud by replacing sensitive information with unique reference numbers.

Image Credit: ZDNet

According to Chakib Bouda, CTO of the Rambus Payments Division, eftpos is the country’s most popular debit payment method, with millions of eftpos-only debit cards distributed across Australia by its members. The partnership between Rambus and eftpos, says Bouda, will allow more than a million consumers to enjoy secure mobile payments with Apple Pay.

“Security and privacy are at the core of Apple Pay. When customers use eftpos debit cards with Apple Pay, the actual card numbers are not stored on the device, nor on Apple servers,” he explained. “Instead, a unique device account number is assigned, encrypted and securely stored in the secure element on a device. Each transaction is authorized with a one-time unique dynamic security code.”

By integrating Rambus’ tokenization software, says Bouda, participating eftpos members can use eftpos debit cards for mobile payments with increased protection, as sensitive primary account numbers (PAN) are replaced with tokens.

Meanwhile, eftpos Acting CEO Paul Jennings noted that eftpos was excited to be one of the world’s first domestic networks to offer tokenization services and support for Apple Pay in Australia.

“Our partnership with Rambus gives us the ability to accelerate our secure mobile payments strategy to support Apple Pay,” he stated.

A closer look at Token Service Providers (TSPs)

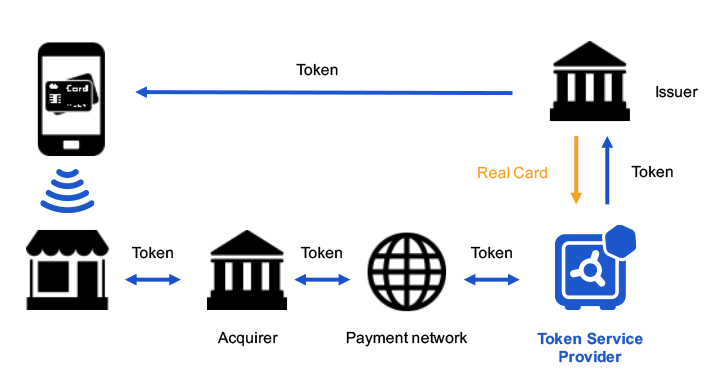

In today’s mobile payment ecosystem, TSPs are entities that generate and deliver payment tokens to registered token requestors, such as OEM Pay wallets or e-commerce merchants, to safely complete mobile payment transactions.

As we briefly discussed above, tokenization is used to protect payment credentials by replacing them with a randomly generated number that resembles the customer’s PAN. The unique identifier, known as a ‘payment token’ or ‘tokenized PAN’, is worthless if stolen, as it essentially acts as a reference for a consumer’s original card data which only the card networks and/or the consumer’s bank can map back to the original account.

Tokens are used in a number of environments to replace and protect the underlying value of credentials. In the payments world, tokenization is primarily used to secure payment card data. This can be done using EMVCo Tokenization for card payment transactions or Payment Card Industry (PCI) Tokenization for card-on-file data, which is stored in merchants’ or acquirers’ systems after a transaction is completed.

Rambus Token Service Provider

The Rambus Token Service Provider is a comprehensive software platform that offers multiple solutions within the tokenized payment infrastructure. Some of the key capabilities featured in the platform include:

- Tokenization Management – reduces fraud by removing confidential consumer card data from the payment network and replacing it with unique tokens. This includes tokenization of primary account numbers (PAN), token vault, de-tokenization, domain management, clearing and settlement support and identification and verification support.

- Host Card Emulation – emulates the functionality of a physical secure element (SE) in the cloud for use with Near Field Communication (NFC) transactions, compliant with American Express, VISA, and MasterCard specifications featuring a plug-in for mobile wallets.

- Transaction Management – enables issuers to perform transactions by calculating cryptogram version numbers (CVNs) on behalf of the authorization host. It includes cryptogram validation, assurance level validation, PAN processing and messaging.

- Trusted Service Manager – issues contactless payment cards and provisions static card data and dynamic key material to a physical SE on a mobile device.

For additional information about Rambus’ mobile payment solutions, please visit our product portfolio here.