Transport and wearables ticketing

A recent report by Juniper Research observes that the future of wearables ticketing will be contactless – primarily across the transport sectors.

“At present, using wearables for making ticket purchases is understandably minimal given the low penetration of capable devices, as well as the lack of supported contactless infrastructure, especially in venues and stadiums,” states Juniper Research analyst Nitin Bhas.

However, says Bhas, with contactless vendors increasingly partnering with transit operators and events ticketing providers, Juniper Research forecasts that contactless tickets purchased via smart wearables will exceed $1 billion in value by 2022.

It should be noted that an October 2017 press release published by Juniper Research forecasted that mobile and wearable ticket purchases will exceed 14 billion by 2018 – accounting for 54% of total digital ticket sales across transport and events sectors. In fact, the total number of transactions via mobile devices is expected to exceed PC-based ticket sales for the first time in 2017, driven primarily by metro and air ticket purchases.

Perhaps not surprisingly, metro, bus and airline app ticketing are the most established in terms of deployment and user adoption, followed closely by events ticketing. By 2020, Juniper projects that the number of digital ticketing users across all platforms will exceed 1.8 billion, with mobile NFC accounting for 215 million unique users.

Juniper Research also confirms that the majority of mobile ticketing deployments, especially in markets such as North America, continues to be dominated by app-based ticketing services, using visual or QR-code authentication. However, analysts emphasize that mobile contactless ticketing is fast becoming the de-facto mode of payment for metro and bus ticketing in selected cities, especially in Europe.

A closer look at the worldwide wearables market

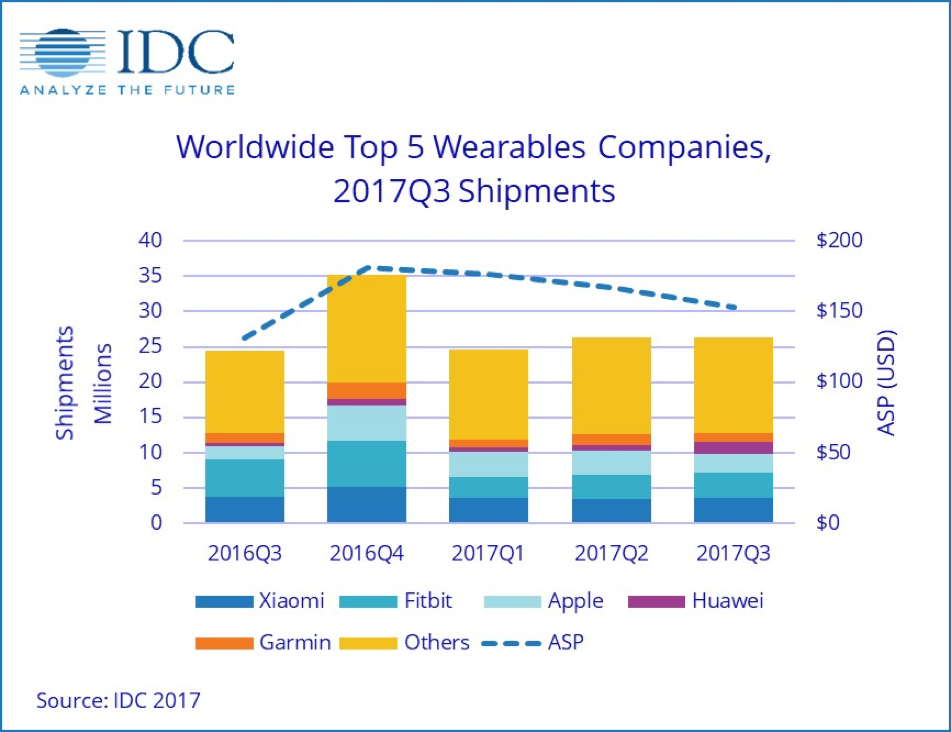

According to IDC, the worldwide wearables market took another important step forward in the third quarter of 2017 (3Q17), with total shipment volume hitting 26.3 million units, up 7.3% year over year. In addition, IDC analysts highlight an increasing trend towards smart wearables (devices capable of running third party applications) and away from basic wearables (devices that cannot run third party applications).

“The differing trajectories for both smart and basic wearables underscore the ongoing evolution for the wearables market,” explains Ramon T. Llamas, research manager for IDC’s Wearables team. “Basic wearables – with devices coming from Fitbit, Xiaomi, and Huawei – helped establish the wearables market. But as tastes and demands have changed towards multi-purpose devices – like smartwatches from Apple, Fossil, and Samsung – vendors find themselves at a crossroads to adjust accordingly to capture growth opportunity and mindshare.”

China set to take the wearables lead

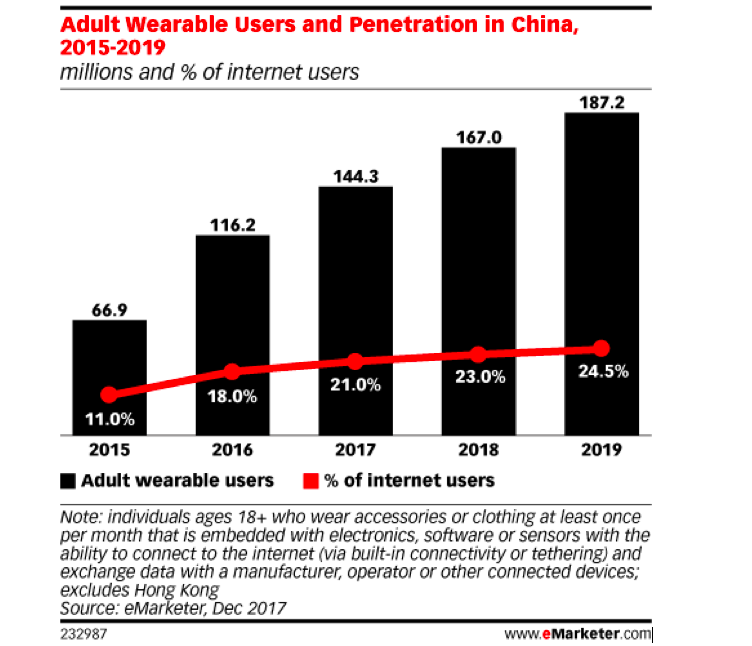

According to eMarketer, wearables adoption in China is expected to surpass rates in the U.S. this year. For example, in 2017, more than one-fifth (21.0%) of adult internet users in China will use a wearable device, such as an Apple Watch or Mi Band, at least once per month.

By comparison, 20.4% of US internet users will be wearable users this year. Moreover, almost a quarter of adult internet users in China can be expected to regularly use a wearable device by 2021.

“Wearable devices will continue to experience high growth among consumers in China,” says Shelleen Shum, senior forecasting analyst at eMarketer. “Thanks to the availability of inexpensive devices with constantly improving functionalities, coupled with an enthusiasm for new technology among working adults, it is not surprising that the adoption of wearable technology is on the rise in China and will surpass the U.S. in 2017.”