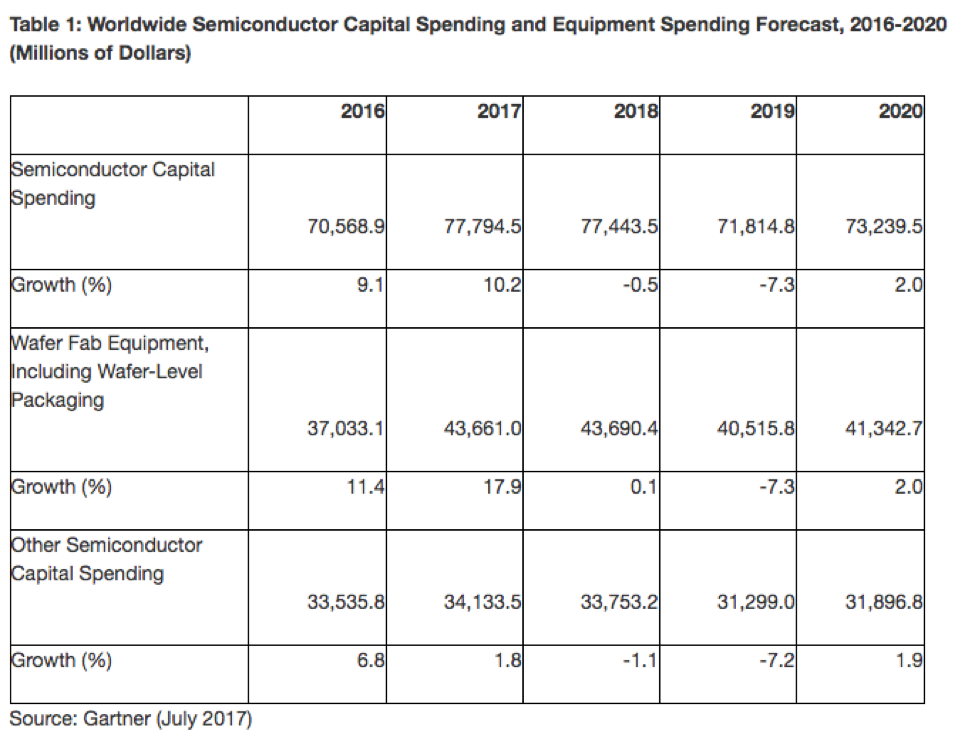

Gartner analysts say worldwide semiconductor capital spending will hit $77.7 billion in 2017, posting an impressive 10.2% increase.

According to Takashi Ogawa, research vice president at Gartner, growth rate is up from the previous quarter’s forecast of 1.4 percent – due to continued aggressive investment in memory and leading-edge logic which is driving spending in wafer-level equipment.

“Spending momentum is more concentrated in 2017 mainly due to strong manufacturing demand in memory and leading-edge logic,” Ogawa elaborated.

“The NAND flash shortage was more pronounced in the first quarter of 2017 than the previous forecast, leading to over 20 percent growth of etch and chemical vapor deposition (CVD) segments in 2017 with a strong capacity ramp-up for 3D NAND.”

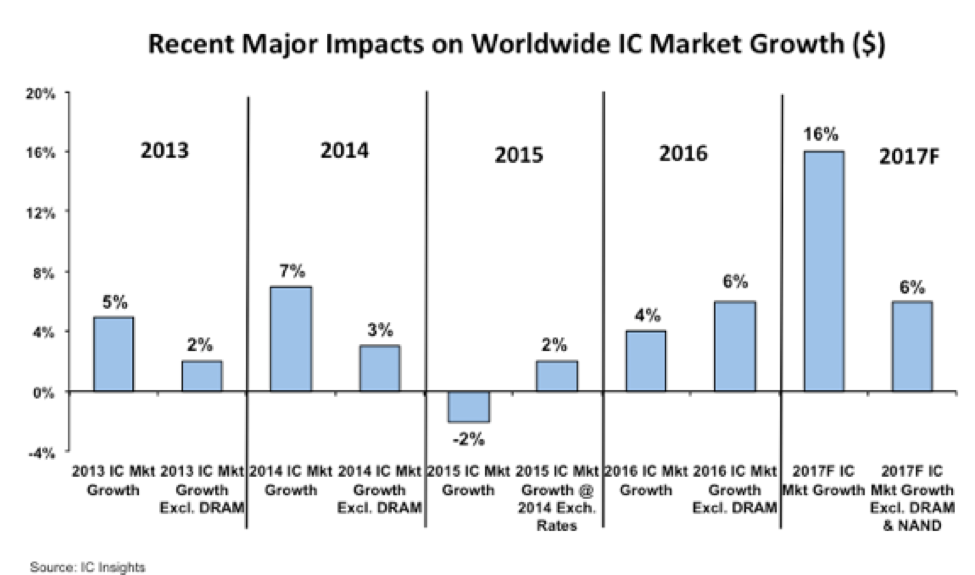

Meanwhile, IC Insights analysts have revised their 2017 outlook and analysis, confirming that the IC industry is on course for a much stronger upturn than was initially forecast in January.

“[We] now expect the IC market to increase 16% in 2017 due to exceptional growth in the DRAM and NAND flash memory markets. The DRAM market is now forecast to grow 55% and the NAND flash market is now expected to rise 35% this year—in both cases, almost entirely due to fast-rising prices rather than unit growth,” IC Insight analysts explained in a recent press release.

“As seen in the figure, the DRAM market has had a notable impact on total IC market growth in recent years. With market surges of 32% and 34% in 2013 and 2014, respectively, the DRAM market alone boosted the worldwide IC market growth rate by three percentage points in 2013 and four percentage points in 2014. At $64.2 billion, the DRAM market is forecast to be by far the largest single product category in the IC industry in 2017, exceeding the expected second-ranked MPU market for standard PCs and servers ($47.1 billion) by $17.1 billion this year.”

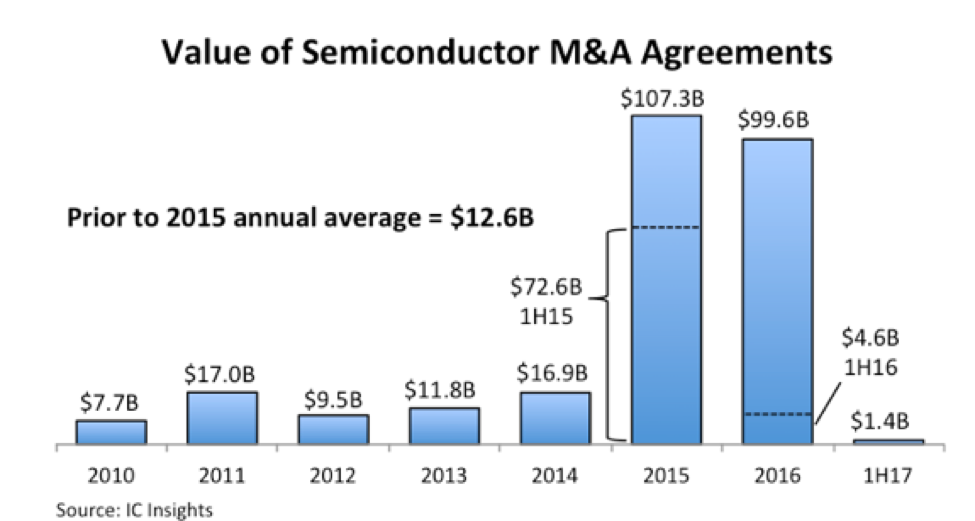

In related semiconductor news, IC Insights has confirmed that the value of semiconductor M&A deals slowed dramatically in 1H17.

“The historic flood of merger and acquisition agreements that swept through the semiconductor industry in the past two years slowed to a trickle in the first half of 2017, with the combined value of about a dozen transactions announced in 1H17 reaching just $1.4 billion,” stated IC Insight analysts.

“The big difference between semiconductor M&A activity in 2017 and the prior two years has been the lack of megadeals. Thus far, only one transaction in 2017 has topped a half billion dollars (MaxLinear’s $687 million cash acquisition of analog and mixed-signal IC supplier Exar announced in March 2017 and completed in May). There were seven announced acquisitions with values of more than $1 billion in 2016 (three of which were over $10 billion) and 10 in 2015 (four of which were over $10 billion).”

Rob Lineback, a senior research analyst at IC Insights, told the EE Times that a combination of factors is likely responsible for the slowdown of M&A activity, including increased regulatory scrutiny and ongoing post-acquisition assessments.

“Governments around the world are scrutinizing a lot of these deals and that may play a role in reducing the numbers of deals that are being struck,” Lineback said. “A lot of companies are going to have to show that these acquisitions are going to pay off and show that they are going to result in a more profit, which of course is what really matters.”

According to Lineback, more semiconductor companies are also acquiring non-semiconductor businesses, effectively reducing the total of straight M&A deals by chip companies.

“We are seeing a lot of that, especially in IoT and virtual reality and automated systems like autonomous vehicles,” he added.