Rambus has launched a comprehensive mobile payments platform to enhance payment security, reduce operational costs and increase revenue for retailers.

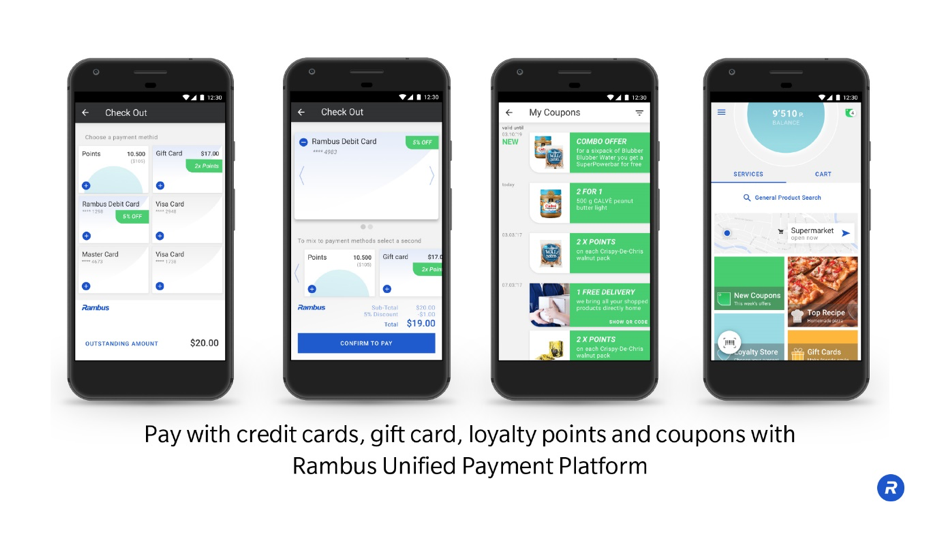

According to Rambus president and CEO Dr. Ron Black, the Rambus Unified Payment Platform securely converts and manages digital value – allowing consumers to seamlessly pay with credit, points and coupons in a single transaction.

“Our Unified Payment Platform is based on a bank-proven foundation from our Bell ID acquisition, utilizing tokenization and card provisioning technology that is in use among the largest banks and payment networks worldwide,” said Black. “Our new platform extends this offering to the retailer, enabling them to incorporate payments and manage digital currencies inside a single app to realize an enhanced frictionless shopping experience.”

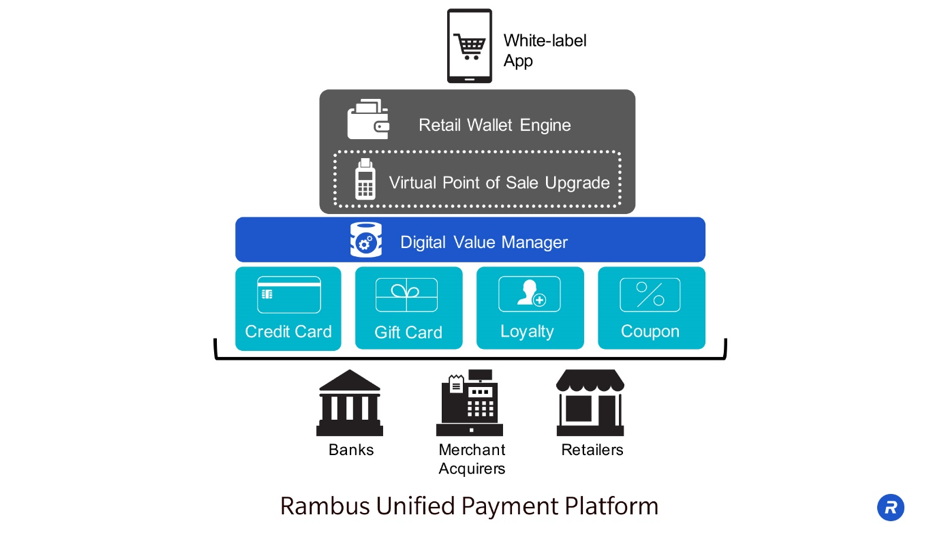

Unified Payment Platform overview

The platform comprises four primary components: A Digital Value Manager, a Retail Wallet Engine, a white-label retail app and a set of optional modules to support credit/debit cards, gift cards, loyalty points and coupons.

Digital Value Manager

The Digital Value Manager is the core of the Unified Payment Platform. It allows retailers to easily connect with multiple third-party service providers and convert various units of digital value into a unified “currency” that can be conveniently managed in a value store.

Retail Wallet Engine

The secure Retail Wallet Engine software – which supports digital card enrollment, card provisioning and tokenization – facilitates full integration with mobile payment products, including the above-mentioned white label app. The Retail Wallet Engine can be upgraded to include integration with virtual Point of Sale (POS) capabilities and inventory management. This integration enables one-click pay and auto-pay to create a truly frictionless commerce experience for consumers.

White-Label App

The white-label software helps accelerates time to market for branded retail apps. The app, which is fully integrated with a suite of Retail Wallet products, features a flexible interface with a complete set of APIs ready to connect to third-party solutions. The white label app also enables in-aisle check-out options, effectively lowering overhead costs and reducing the number of POS terminals.

Customizable Modules

The Rambus Unified Payment Platform offers customers access to a set of optional and fully customizable modules. The modules enable retailers and merchant acquirers to easily and securely connect with third-party services, convert various types of digital value to a unified currency, as well as manage gift cards, loyalty and coupon services in-house.

Specific modules include:

- Credit/Debit Card: Allows retailers to add a credit or debit card, while connecting the scheme to a token gateway for secure access to digitize physical cards into a single wallet.

- Gift Card: Enables consumers to add or purchase gift cards, redeem gift cards, reload, provide balance inquiry and transfer value.

- Loyalty: Tracks new and existing loyalty cards, adds points on purchase, supports payment with points and adds bonus points to incentivize users to buy additional products.

- Coupons: Adds and redeems coupons, enabling retailers to push coupons to consumers in- store or within virtual carts.

Enabling a secure, frictionless shopping experience

The Unified Payment Platform helps retailers enhance security, reduce overhead costs and increase revenue.

- Tokenization replaces key account information with temporary data to minimize the risk of card on file fraud.

- The Retail Wallet Engine enables in-aisle check-out options to lower overhead costs and reduce the number of POS terminals.

- The Unified Payment Platform allows retailers to more easily engage in cross- or up-sell opportunities with integrated loyalty points and coupons. This facilitates direct access to detailed shopping data, enabling retailers, banks and merchant acquirers to offer a personalized shopping experience and more effectively compete in a crowded marketplace.

The Unified Payment Platform offers consumers a seamless shopping experience by unifying multiple units of value—including credit/debit, gift cards, loyalty points and coupons—into a single mobile app, along with digitized receipts and transaction history of purchases.

Interested in learning more about Rambus’ Unified Payment Platform? You can check out our product page here and our eBook below.