eMarketer analysts are projecting that the value of U.S. proximity mobile payment transactions will total $49.29 billion in 2017, up 78.1% from last year. Although the growth rate is expected to remain in double digits, it will slow to 23.9% in 2021, when mobile phones will be used to pay for $189.97 billion worth of goods and services at a physical point of sale (POS).

Average annual spend set to increase

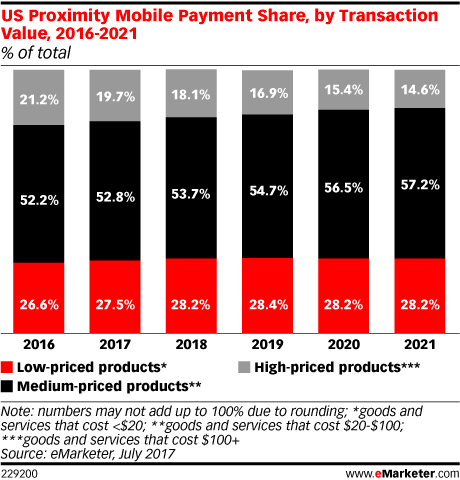

In addition, the average annual spend per proximity mobile payment user in the U.S. is expected to hit $1,026 in 2017, surpassing $1,000 for the first time. The latter figure will continue to grow through 2021, when it is expected to reach $2,646. Interestingly, U.S. consumers are not as likely to use proximity mobile payments to pay for big-ticket items, with eMarketer estimating that items costing more than $100 will account for 19.7% of U.S. proximity mobile payments in 2017 — a figure slated to decline to 14.6% by 2021.

In the meantime, U.S. consumers are using their phones at the POS to pay for coffee, fast food and other low-value, high-frequency purchases at an increasing rate, with low-priced share of proximity mobile payments expected to grow slightly and reach 28.2% in 2021. Medium-priced products such as gas and groceries are projected to make up more than half of US proximity mobile payments through 2021.

17% of U.S. consumers now regularly use their smartphone to pay

In related news, ACI Worldwide’s Global Consumer Survey confirms that global mobile wallet adoption is steadily increasing. More specifically, consumers in the U.S. and Europe are catching up with fast-growing economies in Asia and Latin America where mobile wallets have already become the dominant payment platform. To be sure, 17% of U.S. consumers now regularly use their smartphone to pay, up from 6% in 2014 when the survey was last conducted. In Europe, Spanish consumers are the most active users of mobile wallets, with 25% using them regularly, followed by Italy (24%), Sweden (23%) and the U.K. (14%).

“Mobile wallets really started to grow in popularity after the launch of Apple Pay almost three years ago. What we are seeing is a tipping point regarding adoption, which can be attributed to consumers worldwide now almost exclusively using payment-enabled devices, as older models have cycled out, with a few exceptions,” said Mark Ranta, head of digital banking solutions, ACI Worldwide. “Another important factor in the U.S. is the ubiquity of mobile wallet acceptance. With the EMV rollout behind us, most stores are NFC-enabled and the acceptance of mobile wallets is now almost guaranteed by most larger retailers and even many smaller ones.”

Mobile payments in China and beyond

In addition, says Ranta, China is one of the world’s fastest growing markets and trendsetters when it comes to mobile payments, with the local market dominated by two players – Alipay and WeChatPay.

“Both schemes use optical scanning ‘QR-code’ techniques at the point of sale instead of the plastic card industry standards like NFC (Near Field Communication),” he stated.

“QR-code techniques have grown dramatically in popularity over the last 5 years, on the back of smart phone adoption and the ubiquitous use of social media and digital platforms. These new Chinese payments services are expected to drive new payment behaviors across Asia and globally.”

From a global perspective, says Ranta, the rollout of immediate payments schemes worldwide, combined with new regulation in Europe coming into effect in early 2018, should only increase the importance of mobile payments.

“This will open the door for a range of new players in the payments market and we may see mobile becoming the new plastic sooner than we thought,” he added.