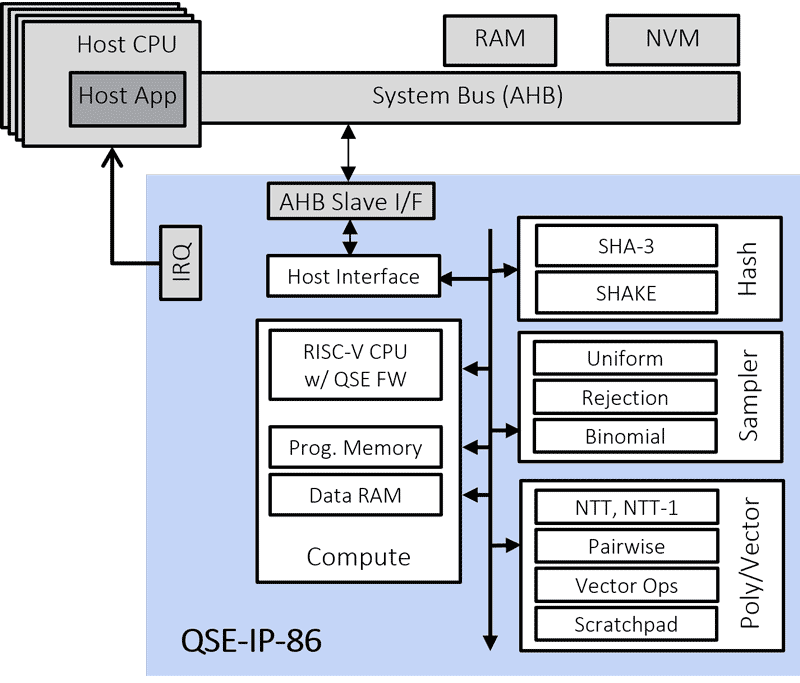

The Rambus Quantum Safe Engine (QSE) IP provides Quantum Safe Cryptography acceleration for ASIC, SoC and FPGA devices. The QSE supports the FIPS 203 ML-KEM and FIPS 204 ML-DSA draft standards. Download the product brief to find out about the QSE features, learn how the QSE can be used for multiple use cases, and review the QSE block diagram.

Rambus Protects Data Center Infrastructure with Quantum Safe Engine IP

Highlights:

- Expands industry-leading family of Quantum Safe IP solutions for data center and government hardware security

- Integrates into root of trust or embedded secure element in advanced SoCs and FPGAs

- Delivers cryptographic acceleration with leading NIST-selected quantum-resistant algorithms

SAN JOSE, Calif. – December 4, 2023 – Rambus Inc. (NASDAQ: RMBS), a premier chip and silicon IP provider making data faster and safer, today announced the availability of a Quantum Safe Engine (QSE) for integration into hardware security elements in ASICs, SoCs and FPGAs. Quantum computers will enable adversaries to break current asymmetric encryption, placing important data and assets at risk. The Rambus QSE IP core uses NIST-selected quantum-resistant algorithms to protect valuable data center and government hardware against attacks emerging in the post quantum computing era.

“From AI, to streaming video, to email, the applications we rely on daily depend on the integrity of data and must be guarded against the growing risk of attacks enabled by quantum computers,” said Neeraj Paliwal, general manager of Silicon IP at Rambus. “The Rambus Quantum Safe Engine is another important addition to our security IP portfolio helping customers transition to Quantum Safe Cryptography starting today.”

“Quantum computers will provide individuals and organizations the exponential speed-up and compute power needed to solve some of today’s most complex problems, including the ability to decrypt current data encryption algorithms,” said Heather West, PhD, research manager of Quantum Computing Research at IDC. “Implementing quantum-resistant cryptography now is key for organizations to protect their past, current and future data from quantum computing enabled attacks.”

The Rambus QSE IP is available as a standalone cryptographic core or integrated in the Rambus Quantum Safe Root of Trust IP as a comprehensive hardware security solution. It supports the National Institute of Standards and Technology (NIST) draft standards for quantum-resistant algorithms (FIPS 203 ML-KEM and FIPS 204 ML-DSA), and provides SHA-3, SHAKE-128 and SHAKE-256 acceleration. For highly secure applications requiring additional protection against differential power analysis (DPA) attacks, a DPA version of the QSE IP is available.

Availability and Additional Information:

The Rambus QSE is available for licensing today. Learn more at https://www.rambus.com/security/quantum-safe-cryptography/qse-ip-86/.

CXL: a promising solution to data center memory bottlenecks?

Join Yole Group and Rambus for an exciting online event that’s set to spark in excitement in the semiconductor industry! Without doubt, CXL has the potential to revolutionize memory utilization, management, and access in terms of disaggregation and composability. This paradigm change, which already occurred in the 90s for storage, gives birth to a new industry focused on CXL memory fabric software, systems, and services.

MEDIA ALERT: Rambus Demonstrates CXL Platform Development Kit at SC23

SAN JOSE, Calif. – November 13, 2023

| What: | Rambus Demonstrates CXL Platform Development Kit Enabling Memory Tiering for AI Infrastructure | |

| Who: | Rambus Inc. (Nasdaq: RMBS), a premier chip and silicon IP provider | |

| Where: | Supercomputing 2023 (SC23) at the CXL Consortium Booth (Booth #1301) at the Colorado Convention Center in Denver, CO | |

| When: | November 14 -16, 2023. Exhibition begins at 10:00 a.m. MT. |

This week at SC23, Rambus will demonstrate a CXL platform development kit (PDK) that enables module and system makers to prototype and test CXL-based memory expansion and pooling solutions for AI infrastructure and other advanced systems. The demonstration will show CXL memory tiering functionality in a production server running industry-standard benchmarking software.

The Rambus CXL PDK is interoperable with CXL 1.1 and CXL 2.0 capable processors and memory from all the major memory suppliers. It leverages today’s available hardware to accelerate the development of the full stack of next-generation CXL-based solutions (device, module, system and software).

The Rambus CXL PDK includes:

- CXL hardware platform (add-in card), featuring Rambus CXL memory controller chip prototype

- Advanced debug and visualization tools

- CXL-compliant management framework and utilities

- Fully customizable SDK for value-added features and vendor-specific commands

Join Rambus at SC23 in the CXL Consortium Booth (Booth 1301) to see the CXL PDK demonstration in action.

To learn more about SC23, visit https://www.rambus.com/event/sc23-supercomputing-2023/. To learn more about the Rambus CXL PDK, visit https://www.rambus.com/cxl-memory-initiative/.

Rambus Reports Third Quarter 2023 Financial Results

- Delivered strong Q3 results with revenue and earnings above the midpoint of guidance

- Generated $51.6 million in cash from operations and completed $100.0 million accelerated share repurchase program

- Completed the sale of the PHY IP business, strengthening focus on chips and digital IP

- Produced quarterly product revenue of $52.2 million driven by memory interface chips

SAN JOSE, Calif. – October 30, 2023 – Rambus Inc. (NASDAQ:RMBS), a provider of industry-leading chips and IP making data faster and safer, today reported financial results for the third quarter ended September 30, 2023. GAAP revenue for the third quarter was $105.3 million, licensing billings were $57.9 million, product revenue was $52.2 million, and contract and other revenue was $24.2 million. The Company also generated $51.6 million in cash provided by operating activities in the third quarter.

“Rambus delivered a strong third quarter, as we continue to execute on our strategy, drive the company’s long-term profitable growth and consistently return value to our stockholders amidst challenging market conditions,” said Luc Seraphin, chief executive officer of Rambus. “We are well positioned to address the increasing memory performance requirements in the data center fueled by AI and other advanced workloads.”

| Quarterly Financial Review – GAAP | Three Months Ended September 30, |

||

| (In millions, except for percentages and per share amounts) | 2023 | 2022 | |

| Revenue | |||

| Product revenue | $52.2 | $58.6 | |

| Royalties | 28.9 | 29.9 | |

| Contract and other revenue | 24.2 | 23.7 | |

| Total revenue | 105.3 | 112.2 | |

| Cost of product revenue | 19.4 | 21.9 | |

| Cost of contract and other revenue | 1.3 | 1.5 | |

| Amortization of acquired intangible assets (included in total cost of revenue) | 3.3 | 3.6 | |

| Total operating expenses (benefits) (1) | (23.6) | 68.3 | |

| Operating income | $104.9 | $16.9 | |

| Operating margin | 100% | 15% | |

| Net income | $103.2 | $0.9 | |

| Diluted net income per share | $0.93 | $0.01 | |

| Net cash provided by operating activities | $51.6 | $80.0 | |

_________________________________________

(1) Includes amortization of acquired intangible assets of approximately $0.3 million and $0.4 million for the three months ended September 30, 2023 and 2022, respectively.

| Quarterly Financial Review – Supplemental Information(1) | Three Months Ended September 30, |

||

| (In millions) | 2023 | 2022 | |

| Licensing billings (operational metric) (2) | $57.9 | $62.2 | |

| Product revenue (GAAP) | $52.2 | $58.6 | |

| Contract and other revenue (GAAP) | $24.2 | $23.7 | |

| Non-GAAP cost of product revenue | $19.2 | $21.8 | |

| Cost of contract and other revenue (GAAP) | $1.3 | $1.5 | |

| Non-GAAP total operating expenses | $52.4 | $54.6 | |

| Non-GAAP interest and other income (expense), net | $1.9 | $1.6 | |

| Diluted share count (GAAP) | 111 | 112 | |

_________________________________________

(1) See “Supplemental Reconciliation of GAAP to Non-GAAP Results” table included below.

(2) Licensing billings is an operational metric that reflects amounts invoiced to our licensing customers during the period, as adjusted for certain differences relating to advanced payments for variable licensing agreements.

GAAP revenue for the quarter was $105.3 million. The Company also had licensing billings of $57.9 million, product revenue of $52.2 million, and contract and other revenue of $24.2 million. The Company had total GAAP cost of revenue of $24.0 million and operating benefits of $(23.6) million. The Company also had total non-GAAP operating expenses of $72.9 million (including non-GAAP cost of revenue of $20.5 million). The Company had GAAP diluted net income per share of $0.93, largely driven by a net gain on divestiture of $90.8 million from the sale of the Company’s PHY IP business in the third quarter. The Company’s basic share count was 108 million shares and its diluted share count was 111 million shares.

Cash, cash equivalents, and marketable securities as of September 30, 2023 were $375.5 million, an increase of $42.9 million from June 30, 2023, mainly due to $51.6 million in cash provided by operating activities and the net proceeds from the PHY IP business divestiture of $106.3 million, partly offset by $100.0 million paid in connection with an accelerated share repurchase program.

2023 Fourth Quarter Outlook

The Company will discuss its full revenue guidance for the fourth quarter of 2023 during its upcoming conference call. The following table sets forth fourth quarter outlook for other measures.

| (In millions) | GAAP | Non-GAAP (1) | |

| Licensing billings (operational metric) (2) | $56 – $62 | $56 – $62 | |

| Product revenue (GAAP) | $52 – $58 | $52 – $58 | |

| Contract and other revenue (GAAP) | $17 – $23 | $17 – $23 | |

| Total operating costs and expenses | $88 – $84 | $73 – $69 | |

| Interest and other income (expense), net | $2 | $2 | |

| Diluted share count | 110 | 110 |

_________________________________________

(1) See “Reconciliation of GAAP Forward-Looking Estimates to Non-GAAP Forward-Looking Estimates” table included below.

(2) Licensing billings is an operational metric that reflects amounts invoiced to our licensing customers during the period, as adjusted for certain differences relating to advanced payments for variable licensing agreements.

For the fourth quarter of 2023, the Company expects licensing billings to be between $56 million and $62 million. The Company also expects royalty revenue to be between $42 million and $48 million, product revenue to be between $52 million and $58 million and contract and other revenue to be between $17 million and $23 million. Revenue is not without risk and achieving revenue in this range will require that the Company sign customer agreements for various product sales and solutions licensing, among other matters.

The Company also expects operating costs and expenses to be between $88 million and $84 million. Additionally, the Company expects non-GAAP operating costs and expenses to be between $73 million and $69 million. These expectations also assume non-GAAP interest and other income (expense), net, of $2 million, a tax rate of 24% and diluted share count of 110 million, and exclude stock-based compensation expense of $11 million, amortization of acquired intangible assets of $4 million, and interest income related to the significant financing component from fixed-fee patent and technology licensing arrangements of $0 million.

Conference Call

The Company’s management will discuss the results of the quarter during a conference call scheduled for 2:00 p.m. PT today. The call, audio and slides will be available online at investor.rambus.com and a replay will be available for the next week at the following numbers: (866) 813-9403 (domestic) or (+1) 929-458-6194 (international) with ID# 195743.

Non-GAAP Financial Information

In the commentary set forth above and in the financial statements included in this earnings release, the Company presents the following non-GAAP financial measures: cost of product revenue, operating expenses and interest and other income (expense), net. In computing each of these non-GAAP financial measures, the following items were considered as discussed below: stock-based compensation expense, acquisition-related costs and retention bonus expense, amortization of acquired intangible assets, restructuring and other charges, expense on abandoned operating leases, facility restoration costs, gain on divestiture, impairment of assets, change in fair value of earn-out liability, gain on sale of equity security, loss on extinguishment of debt, loss on fair value adjustment of derivatives, net, realized loss on sale of marketable securities sold for the purpose of notes repurchase, non-cash interest expense and certain other one-time adjustments. The non-GAAP financial measures disclosed by the Company should not be considered a substitute for, or superior to, financial measures calculated in accordance with GAAP, and the financial results calculated in accordance with GAAP and reconciliations from these results should be carefully evaluated. Management believes the non-GAAP financial measures are appropriate for both its own assessment of, and to show investors, how the Company’s performance compares to other periods. The non-GAAP financial measures used by the Company may be calculated differently from, and therefore may not be comparable to, similarly titled measures used by other companies. A reconciliation from GAAP to non-GAAP results is included in the financial statements contained in this release.

The Company’s non-GAAP financial measures reflect adjustments based on the following items:

Stock-based compensation expense. These expenses primarily relate to employee stock options, employee stock purchase plans, and employee non-vested equity stock and non-vested stock units. The Company excludes stock-based compensation expense from its non-GAAP measures primarily because such expenses are non-cash expenses that the Company does not believe are reflective of ongoing operating results. Additionally, given the fact that other companies may grant different amounts and types of equity awards and may use different option valuation assumptions, excluding stock-based compensation expense permits more accurate comparisons of the Company’s results with peer companies.

Acquisition-related/divestiture costs and retention bonus expense. These expenses include all direct costs of certain acquisitions, divestitures and the current periods’ portion of any retention bonus expense associated with the acquisitions. The Company excludes these expenses in order to provide better comparability between periods as they are related to acquisitions and divestitures and have no direct correlation to the Company’s operations.

Amortization of acquired intangible assets. The Company incurs expenses for the amortization of intangible assets acquired in acquisitions. The Company excludes these items because these expenses are not reflective of ongoing operating results in the period incurred. These amounts arise from the Company’s prior acquisitions and have no direct correlation to the operation of the Company’s core business.

Restructuring and other charges. These charges may consist of severance, contractual retention payments, exit costs and other charges and are excluded because such charges are not directly related to ongoing business results and do not reflect expected future operating expenses.

Expense on abandoned operating leases. Reflects the expense on building leases that were abandoned. The Company excludes these charges because such charges are not directly related to ongoing business results and do not reflect expected future operating expenses.

Facility restoration costs. These charges consist of exit costs associated with our leased office space and are excluded because such charges are not directly related to ongoing business results and do not reflect expected future operating expenses.

Gain on divestiture. Reflects the gain on the sale of the Company’s PHY IP business. The Company excludes these charges (benefits) because such charges (benefits) are not directly related to ongoing business results and do not reflect expected future operating expenses (benefits).

Impairment of assets. These charges primarily consist of non-cash charges to long-lived assets and other assets resulting from the divestiture of the Company’s PHY IP business, and are excluded because such charges are non-recurring and do not reduce the Company’s liquidity.

Change in fair value of earn-out liability. This change is due to adjustments to acquisition purchase consideration. The Company excludes these adjustments because such adjustments are not directly related to ongoing business results and do not reflect expected future operating expenses.

Gain on sale of equity security. The Company has excluded gain on sale of equity security as this is not a reflection of the Company’s ongoing operations.

Loss on extinguishment of debt. The Company has excluded loss on extinguishment of debt as this represents a cost of repurchasing its existing convertible notes and is not a reflection of the Company’s ongoing operations.

Loss on fair value adjustment of derivatives, net. The Company has excluded its loss on fair value adjustment of derivatives, net, as this represents cost and benefits of repurchasing its convertible notes and is not a reflection of the Company’s ongoing operations.

Realized loss on sale of marketable securities sold for the purpose of notes repurchase. The Company has excluded its realized loss on sale of marketable securities sold for the purpose of repurchasing its convertible notes as this is not a reflection of the Company’s ongoing operations.

Non-cash interest expense on convertible notes. The Company incurred non-cash interest expense related to its convertible notes through the first quarter of 2023, at which point the remaining convertible notes matured. The Company excludes non-cash interest expense related to its convertible notes to provide more accurate comparisons of the Company’s results with other peer companies and to more accurately reflect the Company’s ongoing operations.

Income tax adjustments. For purposes of internal forecasting, planning and analyzing future periods that assume net income from operations, the Company estimates a fixed, long-term projected tax rate of approximately 24 percent for both 2023 and 2022, which consists of estimated U.S. federal and state tax rates, and excludes tax rates associated with certain items such as withholding tax, tax credits, deferred tax asset valuation allowance and the release of any deferred tax asset valuation allowance. Accordingly, the Company has applied these tax rates to its non-GAAP financial results for all periods in the relevant years to assist the Company’s planning.

On occasion in the future, there may be other items, such as significant gains or losses from contingencies, that the Company may exclude in deriving its non-GAAP financial measures if it believes that doing so is consistent with the goal of providing useful information to investors and management.

About Rambus Inc.

Rambus is a provider of industry-leading chips and silicon IP making data faster and safer. With over 30 years of advanced semiconductor experience, we are a pioneer in high-performance memory solutions that solve the bottleneck between memory and processing for data-intensive systems. Whether in the cloud, at the edge or in your hand, real-time and immersive applications depend on data throughput and integrity. Rambus products and innovations deliver the increased bandwidth, capacity and security required to meet the world’s data needs and drive ever-greater end-user experiences. For more information, visit rambus.com.

Forward-Looking Statements

This release contains forward-looking statements under the Private Securities Litigation Reform Act of 1995, including those relating to Rambus’ expectations regarding business opportunities, the Company’s ability to deliver long-term, profitable growth, product and investment strategies, and the Company’s outlook and financial guidance for the fourth quarter of 2023 and related drivers, and the Company’s ability to effectively manage supply chain and other market challenges. Such forward-looking statements are based on current expectations, estimates and projections, management’s beliefs and certain assumptions made by the Company’s management. Actual results may differ materially. The Company’s business generally is subject to a number of risks which are described more fully in Rambus’ periodic reports filed with the Securities and Exchange Commission, as well as potential adverse impacts related to, or arising from, COVID-19 and its variants. The Company undertakes no obligation to update forward-looking statements to reflect events or circumstances after the date hereof.

Contact

Desmond Lynch

Senior Vice President, Finance and Chief Financial Officer

(408) 462-8000

[email protected]

Rambus Inc.

Condensed Consolidated Balance Sheets

(Unaudited)

| (In thousands) | September 30, 2023 |

December 31, 2022 |

|

| ASSETS | |||

| Current assets: | |||

| Cash and cash equivalents | $131,957 | $125,334 | |

| Marketable securities | 243,588 | 187,892 | |

| Accounts receivable | 65,101 | 55,368 | |

| Unbilled receivables | 64,252 | 125,698 | |

| Inventories | 34,615 | 20,900 | |

| Prepaids and other current assets | 11,112 | 12,022 | |

| Total current assets | 550,625 | 527,214 | |

| Intangible assets, net | 32,015 | 50,880 | |

| Goodwill | 286,812 | 292,040 | |

| Property, plant and equipment, net | 73,466 | 86,255 | |

| Operating lease right-of-use assets | 20,964 | 24,143 | |

| Deferred tax assets | 131,020 | 3,031 | |

| Unbilled receivables | 3,479 | 25,222 | |

| Income taxes receivable | 84,487 | 1,064 | |

| Other assets | 1,463 | 2,745 | |

| Total assets | $1,184,331 | $1,012,594 | |

| LIABILITIES & STOCKHOLDERS’ EQUITY | |||

| Current liabilities: | |||

| Accounts payable | $15,682 | $24,815 | |

| Accrued salaries and benefits | 13,076 | 20,502 | |

| Convertible notes | — | 10,378 | |

| Deferred revenue | 17,459 | 23,861 | |

| Income taxes payable | 8,638 | 18,137 | |

| Operating lease liabilities | 4,174 | 5,024 | |

| Other current liabilities | 25,167 | 23,992 | |

| Total current liabilities | 84,196 | 126,709 | |

| Long-term liabilities: | |||

| Long-term operating lease liabilities | 26,117 | 29,079 | |

| Long-term income taxes payable | 77,655 | 5,892 | |

| Deferred tax liabilities | 5,819 | 24,964 | |

| Other long-term liabilities | 34,978 | 46,653 | |

| Total long-term liabilities | 144,569 | 106,588 | |

| Total stockholders’ equity | 955,566 | 779,297 | |

| Total liabilities and stockholders’ equity | $1,184,331 | $1,012,594 |

Rambus Inc.

Condensed Consolidated Statements of Operations

(Unaudited)

| Three Months Ended September 30, |

Nine Months Ended September 30, |

||||||

| (In thousands, except per share amounts) | 2023 | 2022 | 2023 | 2022 | |||

| Revenue: | |||||||

| Product revenue | $52,181 | $58,619 | $170,934 | $159,890 | |||

| Royalties | 28,857 | 29,878 | 97,698 | 108,380 | |||

| Contract and other revenue | 24,260 | 23,747 | 70,260 | 64,156 | |||

| Total revenue | 105,298 | 112,244 | 338,892 | 332,426 | |||

| Cost of revenue: | |||||||

| Cost of product revenue | 19,388 | 21,953 | 64,554 | 60,767 | |||

| Cost of contract and other revenue | 1,295 | 1,455 | 4,280 | 3,053 | |||

| Amortization of acquired intangible assets | 3,349 | 3,576 | 10,472 | 10,375 | |||

| Total cost of revenue | 24,032 | 26,984 | 79,306 | 74,195 | |||

| Gross profit | 81,266 | 85,260 | 259,586 | 258,231 | |||

| Operating expenses (benefits): | |||||||

| Research and development | 37,368 | 39,295 | 120,842 | 118,648 | |||

| Sales, general and administrative | 25,333 | 26,198 | 82,484 | 79,409 | |||

| Amortization of acquired intangible assets | 258 | 433 | 1,022 | 1,259 | |||

| Restructuring and other charges (recoveries) | (100) | — | 9,394 | — | |||

| Gain on divestiture | (90,843) | — | (90,843) | — | |||

| Impairment of assets | 10,045 | — | 10,045 | — | |||

| Change in fair value of earn-out liability | (5,666) | 2,411 | 8,134 | (1,889) | |||

| Total operating expenses (benefits) | (23,605) | 68,337 | 141,078 | 197,427 | |||

| Operating income | 104,871 | 16,923 | 118,508 | 60,804 | |||

| Interest income and other income (expense), net | 2,715 | 2,838 | 7,112 | 6,936 | |||

| Gain on fair value of equity security | — | 3,547 | — | 3,547 | |||

| Loss on extinguishment of debt | — | (17,129) | — | (83,626) | |||

| Loss on fair value adjustment of derivatives, net | — | (2,302) | (240) | (10,585) | |||

| Interest expense | (356) | (437) | (1,113) | (1,390) | |||

| Interest and other income (expense), net | 2,359 | (13,483) | 5,759 | (85,118) | |||

| Income (loss) before income taxes | 107,230 | 3,440 | 124,267 | (24,314) | |||

| Provision for (benefit from) income taxes | 4,032 | 2,501 | (151,092) | 5,945 | |||

| Net income (loss) | $103,198 | $939 | $275,359 | $(30,259) | |||

| Net income (loss) per share: | |||||||

| Basic | $0.95 | $0.01 | $2.54 | $(0.27) | |||

| Diluted | $0.93 | $0.01 | $2.48 | $(0.27) | |||

| Weighted average shares used in per share calculation | |||||||

| Basic | 108,317 | 109,968 | 108,412 | 110,102 | |||

| Diluted | 110,775 | 111,962 | 111,179 | 110,102 | |||

Rambus Inc.

Supplemental Reconciliation of GAAP to Non-GAAP Results

(Unaudited)

| Three Months Ended September 30, |

|||

| (In thousands) | 2023 | 2022 | |

| Cost of product revenue | $19,388 | $21,953 | |

| Adjustment: | |||

| Stock-based compensation expense | (149) | (142) | |

| Non-GAAP cost of product revenue | $19,239 | $21,811 | |

| Total operating expenses (benefits) | $(23,605) | $68,337 | |

| Adjustments: | |||

| Stock-based compensation expense | (9,889) | (8,730) | |

| Acquisition-related costs and retention bonus expense | (37) | (1,627) | |

| Amortization of acquired intangible assets | (258) | (433) | |

| Restructuring and other recoveries | 100 | — | |

| Expense on abandoned operating leases | (40) | (520) | |

| Facility restoration costs | 3 | — | |

| Severance costs | (373) | — | |

| Gain on divestiture | 90,843 | — | |

| Impairment of assets | (10,045) | — | |

| Change in fair value of earn-out liability | 5,666 | (2,411) | |

| Non-GAAP total operating expenses | $52,365 | $54,616 | |

| Interest and other income (expense), net | $2,359 | $(13,483) | |

| Adjustments: | |||

| Interest income related to significant financing component from fixed-fee patent and technology licensing arrangements | (426) | (1,248) | |

| Non-cash interest expense on convertible notes | — | 33 | |

| Gain on sale of equity security | — | (3,547) | |

| Loss on extinguishment of debt | — | 17,129 | |

| Loss on fair value adjustment of derivatives, net | — | 2,302 | |

| Realized loss on sale of marketable securities sold for the purpose of notes repurchase | — | 450 | |

| Non-GAAP interest and other income (expense), net | $1,933 | $1,636 | |

Rambus Inc.

Reconciliation of GAAP Forward-Looking Estimates to Non-GAAP Forward-Looking Estimates

(Unaudited)

| 2023 Fourth Quarter Outlook | Three Months Ended December 31, 2023 |

|||

| (In millions) | Low | High | ||

| Forward-looking operating costs and expenses | $87.5 | $83.5 | ||

| Adjustments: | ||||

| Stock-based compensation expense | (11.0) | (11.0) | ||

| Amortization of acquired intangible assets | (3.5) | (3.5) | ||

| Forward-looking Non-GAAP operating costs and expenses | $73.0 | $69.0 | ||

| Forward-looking interest and other income (expense), net | $2.2 | $2.2 | ||

| Adjustments: | ||||

| Interest income related to significant financing component from fixed-fee patent and technology licensing arrangements | (0.2) | (0.2) | ||

| Forward-looking Non-GAAP interest and other income (expense), net | $2.0 | $2.0 | ||

Rambus Boosts AI Performance with 9.6 Gbps HBM3 Memory Controller IP

Highlights:

- Enhances Rambus high-performance memory IP portfolio for AI/ML and other advanced data center workloads

- Supports future evolution of HBM3 memory standard with up to 9.6 Gbps data rates

- Enables industry-leading memory throughput of over 1.2 TB/s

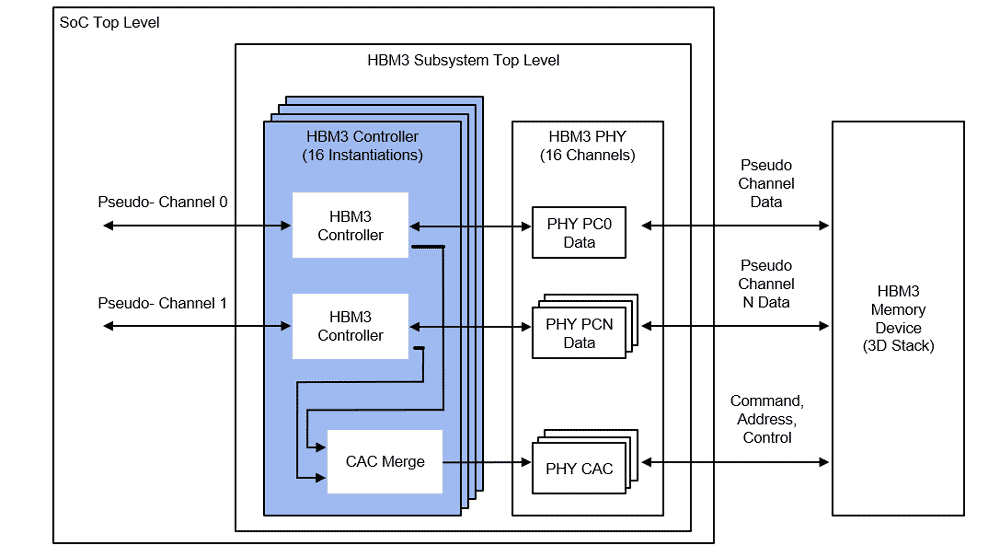

SAN JOSE, Calif. – Oct. 25, 2023 – Rambus Inc. (NASDAQ: RMBS), a premier chip and silicon IP provider making data faster and safer, today announced that the Rambus HBM3 Memory Controller IP now delivers up to 9.6 Gigabits per second (Gbps) performance supporting the continued evolution of the HBM3 standard. With a 50% increase over the HBM3 Gen1 data rate of 6.4 Gbps, the Rambus HBM3 Memory Controller can enable a total memory throughput of over 1.2 Terabytes per second (TB/s) for training of recommender systems, generative AI and other demanding data center workloads.

“HBM3 is the memory of choice for AI/ML training, with large language models requiring the constant advancement of high-performance memory technologies,” said Neeraj Paliwal, general manager of Silicon IP at Rambus. “Thanks to Rambus innovation and engineering excellence, we’re delivering the industry’s leading-edge performance of 9.6 Gbps in our HBM3 Memory Controller IP.”

“HBM is a crucial memory technology for faster, more efficient processing of large AI training and inferencing sets, such as those used for generative AI,” said Soo-Kyoum Kim, vice president, memory semiconductors at IDC. “It is critical that HBM IP providers like Rambus continually advance performance to enable leading-edge AI accelerators that meet the demanding requirements of the market.”

HBM uses an innovative 2.5D/3D architecture which offers a high memory bandwidth and low power consumption solution for AI accelerators. With excellent latency and a compact footprint, it has become a leading choice for AI training hardware.

The Rambus HBM3 Memory Controller IP is designed for use in applications requiring high memory throughput, low latency and full programmability. The Controller is a modular, highly configurable solution that can be tailored to each customer’s unique requirements for size and performance. Rambus provides integration and validation of the HBM3 Controller with the customer’s choice of third-party HBM3 PHY.

Availability and Additional Information:

The Rambus HBM3 Memory Controller is available for licensing today. Learn more at www.rambus.com/interface-ip/hbm/