Join Parvez Shaik as he discusses the three-tiered CryptoManager architecture and how it can be implemented in chip designs to safeguard against cyber attacks (including emerging quantum-based attacks) and side-channel exploits.

CryptoManager RT-7xx Embedded HSM Family Product Brief

The automotive-grade CryptoManager RT-7xx v3 Root of Trust family from Rambus is the next generation of fully programmable ISO 26262 and ISO 21434 compliant hardware security modules offering Quantum Safe security by design for secure automotive applications. Download the product brief to learn more about the Rambus CryptoManager RT-7xx Embedded HSM Family.

CryptoManager Hub and CryptoManager Core CH-6xx and CC-6xx Product Brief

CryptoManager Hub (CMH) and CryptoManager Core (CMC) from Rambus are the next-generation of flexible and configurable cryptographic family of accelerator cores comprised of the CMH CH-6xx and CMC CC-6xx designs and are intended for embedding in customer or Rambus provided Root of Trust security modules. Download the brief to learn more about the Rambus CryptoManager Hub and CryptoManager Core CH-6xx and CC-6xx.

CryptoManager RT-6xx Root of Trust Family Product Brief

The CryptoManager RT-6xx v3 Root of Trust family from Rambus is the latest generation of fully programmable FIPS 140-3 compliant hardware security cores offering Quantum Safe security by design for data center and other highly secure applications. Download the brief to learn more about the CryptoManager RT-6xx Root of Trust Family.

CryptoManager Hub and CryptoManager Core CH-7xx and CC-7xx Product Brief

The automotive-grade CryptoManager Hub (CMH) and CryptoManager Core (CMC) from Rambus are the next-generation of flexible and configurable cryptographic family of accelerator cores comprised of the CMH CH-7xx and CMC CC-7xx designs and are intended for embedding in customer or Rambus provided HSM security modules. Download the brief to learn more about the Rambus CryptoManager Hub and CryptoManager Core CH-7xx and CC-7xx.

Rambus Enhances Data Center and AI Protection with Next-Gen CryptoManager Security IP Solutions

Highlights:

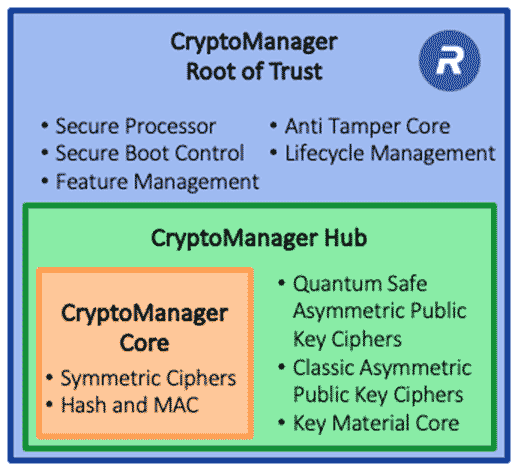

- Offers multi-tiered architecture with progressively higher levels of functionality and security for unmatched customer flexibility

- Supports fast time to market with security solutions spanning a broad set of certifications including FIPS, SESIP, PSA and ISO 26262 & 21434

- Safeguards against current and future cyberthreats with industry-leading anti-tamper and Quantum Safe protection

SAN JOSE, Calif. – March 10, 2025 – Rambus Inc. (NASDAQ: RMBS), a premier chip and silicon IP provider making data faster and safer, today announced the introduction of its next-generation CryptoManager Security IP solutions including Root of Trust, Hub and Core families. The CryptoManager Security IP offerings deliver progressively higher levels of functional integration and security, enabling customers to choose the level of security features and capabilities best suited to their unique requirements.

The CryptoManager Root of Trust delivers a fully-turnkey solution and offers the industry’s first Quantum Safe boot flow. The CryptoManager Hub provides the ideal combination of proven cryptographic building blocks for customers designing their own root of trust or secure processor. With support for a broad set of security functionality and certifications, Rambus CryptoManager Security IP solutions help customers accelerate the time to market of chips for the data center, AI and other advanced applications.

“The pace of value creation in the data center driven by AI is unprecedented, and the need to protect this value grows commensurately,” said Matt Jones, SVP and general manager of Silicon IP at Rambus. “The multi-tiered architecture of our new generation CryptoManager Security IP lets us serve a broader set of customers with solutions that provide an unrivaled level of flexibility and industry-leading protection of valuable hardware and data assets.”

“Rebellions builds energy-efficient AI accelerators optimized for Generative AI workloads in Data Center and Enterprise Inference applications,” said Sunghyun Park, co-founder & CEO of Rebellions. “Security is a critical component for ensuring the confidentiality, integrity, authenticity, and availability of data and devices. The CryptoManager solutions from Rambus offer a range of options to meet our performance, security, and area requirements, so we can fully address our customer application demands.”

CryptoManager Security IP solutions include:

- CryptoManager Root of Trust products offer fully programmable security processor functionality including multithreading and multi-host capabilities. A complete turnkey solution, the CryptoManager Root of Trust family represents the highest level of security integration with advanced anti-tamper and Quantum Safe protection for boot and HW acceleration.

- CryptoManager Hub products are the ultimate solution for customers looking to build their own Root of Trust or security processor, ensuring unparalleled protection and performance. CryptoManager Hub products feature a state-of-the-art suite of symmetric, asymmetric, and Quantum Safe cryptographic accelerators along with certified true random number generators designed to meet the highest security standards for a broad set of applications.

- CryptoManager Core products are a state-of-the-art suite of symmetric cryptographic accelerators designed to provide unmatched flexibility for customers building their own Root of Trust solutions.

More Information

CryptoManager Security IP products are certified to FIPS 140-3, SESIP, PSA, ISO 26262 and ISO 21434 for applications across data center, automotive, government and military. For more details, visit Rambus Security IP. Rambus will host a webinar “Implementing State-of-the-Art Digital Protection with Rambus CryptoManager Security IP,” discussing the application and implementation of CryptoManager Security IP products on April 16, 2025 from 10:00am – 11:00am PT. Additional info on the next-gen CryptoManager Security IP solutions including Root of Trust, Hub and Core families can be found on the Rambus blog, “Rambus CryptoManager Root of Trust Solutions Tailor Security Capabilities to Specific Customer Needs with New Three-Tier Architecture.”