A new survey conducted by First Annapolis confirms that mobile wallets have proliferated over the past year, with issuers introducing proprietary solutions to compete with Apple, Samsung and Android Pay. Interestingly, two thirds of respondents reported having made a mobile payment, while approximately two out of five have a mobile wallet—yet only a handful are frequent Pay users.

More specifically, 64% of respondents made a mobile payment over the last year, with more than 85% of those under 35 having made a mobile payment, along with 36% of those over 65. In addition, 39% of respondents have a mobile wallet; of those, 49% are enrolled in a Pay. Satisfaction with mobile wallets apps is high – and 36% of mobile wallet users say they would use mobile payments for “almost all” of their purchases, if they could.

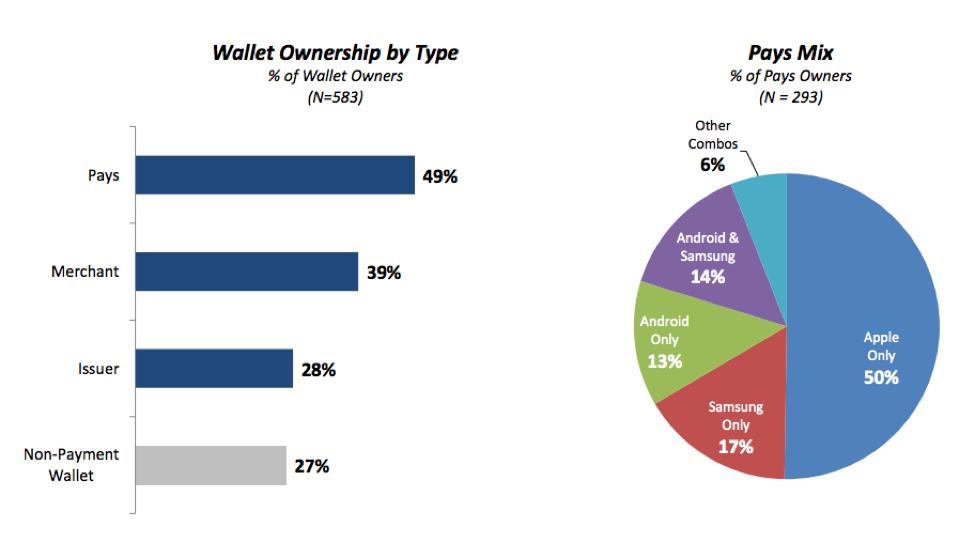

Consumers also noted that they would like one payment app on their phone—and they want their bank to provide it. Currently, the Pays are the most frequently cited wallet type, cited by 49% of wallet owners (as stated above), with Apple Pay being the most common. While Apple Pay has the highest penetration, activation and usage (PAU) metrics, First Annapolis reports that the service’s user base appears to be stabilizing in the short-term, as growth of compatible devices slow and penetration and activation metrics level off.

Image Credit: First Annapolis

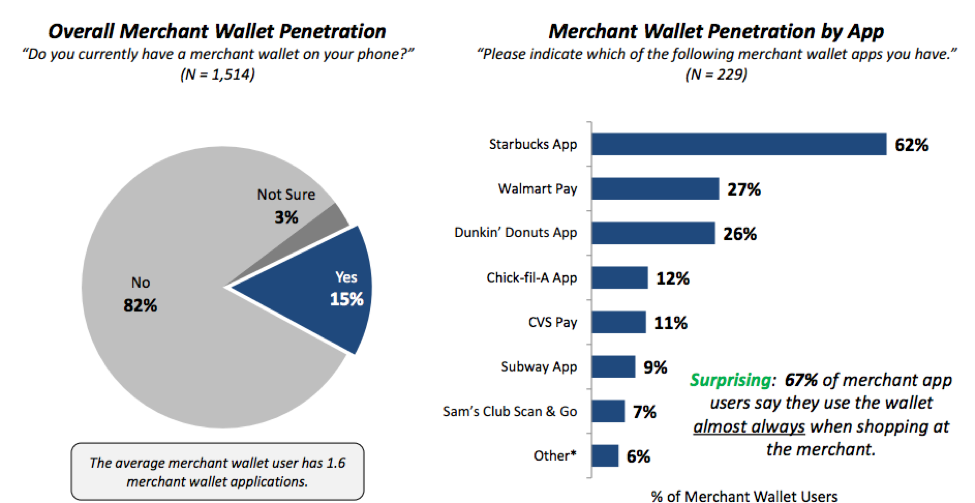

Perhaps not surprisingly, 15% of respondents confirmed they have a merchant payment solution, with Starbucks cited the most frequently. In addition, more than 75% of respondents indicated they receive rewards as part of mobile wallet usage. To be sure, two in five respondents would not have downloaded the app without rewards.

Image Credit: First Annapolis

Although consumers are not yet ready to leave home without their physical wallet, mobile wallet payments are poised for growth. Indeed, many consumers are supplementing the Pays or an issuer wallet with individual merchant apps, although most would prefer a single payment app. It should be noted that less than one in ten respondents indicated they have an issuer wallet (Chase and Capital One were the most frequently cited).

As we’ve previously discussed on Rambus Press, mobile payments provide a convenient “tap and go” frictionless commerce experience that effectively eliminates checkout lines at stores and long queues at bus and train stations. However, mass adoption of mobile payments will only be achieved when there is a single, unified platform built on an economy of digital trust that ensures an uninterrupted physical to digital experience. As such, mobile wallets must provide more than a convenient place to store virtual cards by integrating loyalty programs, gift cards, receipts and payment history in a single app. In addition, consumers require assurances that their mobile payment information will remain secure. Similarly, stores and financial institutions need to be confident that the technology behind mobile payments is secure and easy-to-use before it can be truly embraced.

Interested in learning more about mobile payments and wallets? You can check out our product page here and our eBook on the subject below.