Rambus has demonstrated that its HBM2E solution, which consists of a memory controller and a verified 1024-bit PHY, can operate at a whopping 4.0 Gbps data transfer rate per pin. The demonstration is meant to prove potential clients that the HBM2E solution can scale and offer a 25% higher peak bandwidth than is officially defined by JEDEC’s HBM2E standard.

Rambus Demonstrates HBM2E Running at 4 Gbps: 512 GB/s per HBM2E Stack

Rambus Advances HBM2E Performance to 4.0 Gbps for AI/ML Training Applications

Highlights:

- Fully-integrated HBM2E memory interface solution, consisting of verified PHY and controller, achieves industry’s fastest performance

- New benchmark in performance supports accelerators requiring terabyte-scale bandwidth for artificial intelligence/machine learning (AI/ML) training applications

- Partners with SK hynix and Alchip to develop 2.5D HBM2E memory system solution using TSMC N7 process and CoWoS® advanced packaging technologies

- Offers unrivaled system expertise supporting customers with interposer and package reference designs to speed time to market

Read first our primer on:

HBM2E Implementation & Selection – The Ultimate Guide »

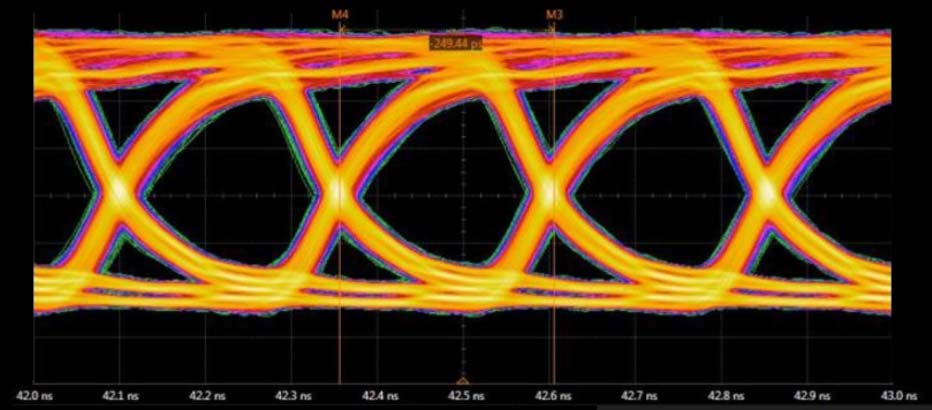

SAN JOSE, Calif. – Sept. 9, 2020 – Rambus Inc. (NASDAQ: RMBS), a premier silicon IP and chip provider making data faster and safer, today announced it has achieved a record 4 Gbps performance with the Rambus HBM2E memory interface solution consisting of a fully-integrated PHY and controller. Paired with the industry’s fastest HBM2E DRAM from SK hynix operating at 3.6 Gbps, the solution can deliver 460 GB/s of bandwidth from a single HBM2E device. This performance meets the terabyte-scale bandwidth needs of accelerators targeting the most demanding AI/ML training and high-performance computing (HPC) applications.

“With this achievement by Rambus, designers of AI and HPC systems can now implement systems using the world’s fastest HBM2E DRAM running at 3.6 Gbps from SK hynix,” said Uksong Kang, vice president of product planning at SK hynix. “In July, we announced full-scale mass-production of HBM2E for state-of-the-art computing applications demanding the highest bandwidth available.”

The fully-integrated, production-ready Rambus HBM2E memory subsystem runs at 4 Gbps without PHY voltage overdrive. Rambus teamed with SK hynix and Alchip to implement the HBM2E 2.5D system to validate in silicon the Rambus HBM2E PHY and Memory Controller IP using TSMC’s N7 process and CoWoS® (Chip-on-Wafer-on-Substrate) advanced packaging technologies. Co-designing with the engineering team from Rambus, Alchip led the interposer and package substrate design.

“This advancement of Rambus and its partners, using TSMC’s advanced process and packaging technologies, is another important achievement of our ongoing collaboration with Rambus,” said Suk Lee, senior director of the Design Infrastructure Management Division at TSMC. “We look forward to a continued partnership with Rambus to enable the highest performance in AI/ML and HPC applications.”

“Alchip brought a demonstrated track record of success in 7nm and 2.5D package design to this initiative,” said Johnny Shen, CEO of Alchip Technologies. “We’re extremely proud of our contributions to Rambus’ breakthrough achievement.”

Rambus has 30 years of high-speed memory design applied to the most demanding computing applications. Its renowned signal integrity expertise was key to achieving an HBM2E memory interface capable of 4 Gbps operation. This raises a new benchmark for meeting the insatiable bandwidth requirements of AI/ML training.

“With silicon operation up to 4 Gbps, designers can future-proof their HBM2E implementations and can be confident of ample margin for 3.6 Gbps designs,” said Matthew Jones, senior director and general manager of IP cores at Rambus. “As part of every customer engagement, Rambus provides reference designs for the 2.5D package and interposer to ensure first-time right implementations for mission-critical AI/ML designs.”

Benefits of the Rambus HBM2E Memory Interface (PHY and Controller):

- Achieves the industry’s highest speed of 4 Gbps per pin, delivering a system bandwidth of 460 GB from a single 3.6 Gbps HBM2E DRAM 3D device.

- Fully-integrated and verified HBM2E PHY and Controller reduces ASIC design complexity and speeds time to market

- Includes 2.5D package and interposer reference design as part of IP license

- Provides access to Rambus system and SI/PI experts helping ASIC designers to ensure maximum signal and power integrity for devices and systems

- Features LabStation™ development environment that enables quick system bring-up, characterization and debug

- Supports high-performance applications including state-of-the-art AI/ML training and high-performance computing (HPC) systems

For more information on the Rambus Interface IP, including our PHYs and Controllers, please visit rambus.com/interface-ip.

Micron Reveals GDDR6X Details: The Future of Memory, or a Proprietary DRAM?

Micron Technology shared some additional details about its latest GDDR6X SGRAM used by Nvidia’s GeForce RTX 30-series graphics cards at a virtual briefing last week. The company revealed that it has experimented for more than a decade with technologies enabling the new type of memory and said that GDDR6X SGRAM had not been standardized by JEDEC yet. Right now, only Nvidia uses GDDR6X memory, but Micron hopes this will change over time. Can it?

Rambus and Micron Extend Patent License Agreement

SAN JOSE, Calif. – Sept 3, 2020 – Rambus Inc. (Nasdaq: RMBS), a premier silicon IP and chip provider making data faster and safer, today announced it has extended its patent license agreement with Micron for an additional four years. The extension maintains the existing financial terms of the agreement and provides Micron with a license to the extensive portfolio of Rambus patents until December 1, 2024.

“We are very pleased Micron has extended their patent license agreement and with how our broader relationship has grown over time,” said Kit Rodgers, senior vice president of technology partnerships and corporate development at Rambus. “We look forward to our continued collaboration in the future.”

Micron Spills on GDDR6X: PAM4 Signaling For Higher Rates, Coming to NVIDIA’s RTX 3090

It would seem that Micron this morning has accidentally spilled the beans on the future of graphics card memory technologies – and outed one of NVIDIA’s next-generation RTX video cards in the process. In a technical brief that was posted to their website, dubbed “The Demand for Ultra-Bandwidth Solutions”, Micron detailed their portfolio of high-bandwidth memory technologies and the market needs for them. Included in this brief was information on the previously-unannounced GDDR6X memory technology, as well as some information on what seems to be the first card to use it, NVIDIA’s GeForce RTX 3090.

Rambus Reports Second Quarter 2020 Financial Results

- Excellent quarter, at the high end of expectations for revenue and profit

- $62.0 million in cash provided by operating activities, the highest quarterly cash generation in over 10 years

- Fifth consecutive quarter of record revenue from memory interface chips driven by strong demand in data center

SAN JOSE, Calif. – August 3, 2020 – Rambus Inc. (NASDAQ:RMBS), a premier silicon IP and chip provider making data faster and safer, today reported financial results for the second quarter ended June 30, 2020. GAAP revenue for the second quarter was $59.9 million; licensing billings were $60.7 million, product revenue was $31.7 million, and contract and other revenue was $11.2 million. The Company also generated $62.0 million in cash provided by operating activities.

“Rambus had a superb second quarter with cash generated from operations at a 10-year high and our chip business delivering its fifth consecutive quarter of record revenue,” said Luc Seraphin, chief executive officer of Rambus. “This tremendous performance was enabled by our sustained focus on quality and execution, demonstrating our ability to consistently deliver.”

Business Review

The need for increased bandwidth, capacity and security across all data-centric applications continues to create strong sustained demand for products and solutions that improve the performance of the global data infrastructure and drive Rambus growth.

The Company’s memory interface chip business continued its growth trajectory, with a fifth consecutive quarter of record revenue. This performance was driven by a combination of increased data center and OEM qualifications, and an overall increase in market demand. With the recent industry publication of the DDR5 memory specification, Rambus remains poised as a market leader to support our customers’ next-generation systems.

The Rambus Silicon IP business maintained its momentum with design wins for interface and security IP at tier-1 SoC makers across data center, AI and 5G. With the availability of the cutting-edge 112G XSR SerDes for chiplets and co-packaged optics, the Company continues to deliver solutions that enable leading-edge architectures and capabilities for high-performance systems.

| Quarterly Financial Review – GAAP | Three Months Ended June 30, |

||||||

| (In millions, except for percentages and per share amounts) | 2020 | 2019 | |||||

| Revenue | |||||||

| Royalties | $17.0 | $27.1 | |||||

| Product revenue | 31.7 | 16.0 | |||||

| Contract and other revenue | 11.2 | 15.2 | |||||

| Total revenue | $59.9 | $58.3 | |||||

| Cost of product revenue | $10.3 | $6.3 | |||||

| Cost of contract and other revenue | $1.5 | $2.9 | |||||

| Amortization of acquired intangible assets (included in total cost of revenue) | $4.3 | $3.8 | |||||

| Total operating expenses (1) | $56.2 | $82.3 | |||||

| Operating loss | $(12.5) | $(37.0) | |||||

| Operating margin | (21)% | 64% | |||||

| Net loss | $(10.8) | $(37.0) | |||||

| Diluted net loss per share | $(0.09) | $(0.33) | |||||

| Net cash provided by operating activities | $62.0 | $38.7 | |||||

(1) Includes amortization of acquired intangible assets of approximately $0.2 million and $1.1 million for the three months ended June 30, 2020 and 2019, respectively.

| Quarterly Financial Review – Non-GAAP (including operational metric) (1) | Three Months Ended June 30, |

||||||

| (In millions) | 2020 | 2019 | |||||

| Licensing billings (2) | $60.7 | $64.9 | |||||

| Product revenue | $31.7 | $16.0 | |||||

| Contract and other revenue | $11.2 | $15.2 | |||||

| Cost of product revenue | $10.3 | $6.3 | |||||

| Cost of contract and other revenue | $1.5 | $2.9 | |||||

| Total operating expenses | $47.7 | $54.9 | |||||

| Interest and other income (expense), net | $0.1 | $0.9 | |||||

| Diluted share count | 115 | 113 | |||||

(1) See “Supplemental Reconciliation of GAAP to Non-GAAP Results” table included below. Note that the applicable non-GAAP measures are presented and that revenue, cost of product revenue and cost of contract and other revenue are solely presented on a GAAP basis.

(2) Licensing billings is an operational metric that reflects amounts invoiced to our licensing customers during the period, as adjusted for certain differences.

GAAP revenue for the quarter was $59.9 million, at the high end of expectations due to the Company’s strong performance in its memory interface chip business. The Company also had licensing billings of $60.7 million, product revenue of $31.7 million, and contract and other revenue of $11.2 million. Rambus had total GAAP cost of revenue of $16.1 million and operating expenses of $56.2 million. The Company also had total non-GAAP operating expenses of $59.5 million (which includes non-GAAP cost of revenue), below the low end of its expectations through its cost management actions. Due to the Company’s strong performance and cost management actions, its revenue and profit were at the high end of its expectations. The Company had GAAP diluted net loss per share of $0.09. The Company’s basic share count was 114 million shares and its diluted share count would have been 115 million shares.

Cash, cash equivalents, and marketable securities as of June 30, 2020 were $486.1 million, an increase of $50.7 million from March 31, 2020, mainly due to $62.0 million in cash provided by operating activities, the highest quarterly cash generation in over 10 years.

2020 Third Quarter Outlook

The Company will discuss its full revenue guidance for the third quarter of 2020 during its upcoming conference call. The following table sets forth third quarter outlook for other measures.

| (In millions) | GAAP | Non-GAAP (1) | |

| Licensing billings (2) | $55 – $61 | $55 – $61 | |

| Product revenue | $29 – $35 | $29 – $35 | |

| Contract and other revenue | $10 – $16 | $10 – $16 | |

| Total operating costs and expenses | $76 – $72 | $64 – $60 | |

| Interest and other income (expense), net | $2 | $0 | |

| Diluted share count | 116 | 116 |

(1) See “Reconciliation of GAAP Forward Looking Estimates to Non-GAAP Forward Looking Estimates” table included below. Note that the applicable non-GAAP measures are presented, and that revenue is solely presented on a GAAP basis.

(2) Licensing billings is an operational metric that reflects amounts invoiced to our licensing customers during the period, as adjusted for certain differences. This metric is the same for both GAAP and non-GAAP presentations.

For the third quarter of 2020, the Company expects licensing billings to be between $55 million and $61 million. The Company also expects royalty revenue to be between $9 million and $15 million, product revenue to be between $29 million and $35 million and contract and other revenue to be between $10 million and $16 million. Revenue is not without risk and achieving revenue in this range will require that the Company sign customer agreements for various product sales, solutions licensing among other matters.

The Company also expects operating costs and expenses to be between $76 million and $72 million. Additionally, the Company expects non-GAAP operating costs and expenses to be between $64 million and $60 million. These expectations also assume non-GAAP interest and other income (expense), net, of $0 million, tax rate of 24% and diluted share count of 116 million, and exclude stock-based compensation expense ($7 million), amortization expense ($5 million), non-cash interest expense on convertible notes ($2 million) and interest income related to the significant financing component from fixed-fee patent and technology licensing arrangements ($3 million).

Conference Call:

Rambus management will discuss the results of the quarter during a conference call scheduled for 2:00pm PT today. The call, audio and slides will be available online at investor.rambus.com and a replay will be available for the next week at the following numbers: (855) 859-2056 (domestic) or (404) 537-3406 (international) with ID# 1788075.

Non-GAAP Financial Information:

In the commentary set forth above and in the financial statements included in this earnings release, the Company presents the following non-GAAP financial measures: operating expenses and interest and other income (expense), net. In computing each of these non-GAAP financial measures, the following items were considered as discussed below: stock-based compensation expense, acquisition-related costs and retention bonus expense, restructuring charges, impairment of assets held for sale, amortization expense, escrow settlement refund, non-cash interest expense and certain other one-time adjustments. The non-GAAP financial measures disclosed by the Company should not be considered a substitute for, or superior to, financial measures calculated in accordance with GAAP, and the financial results calculated in accordance with GAAP and reconciliations from these results should be carefully evaluated. Management believes the non-GAAP financial measures are appropriate for both its own assessment of, and to show investors, how the Company’s performance compares to other periods. The non-GAAP financial measures used by the Company may be calculated differently from, and therefore may not be comparable to, similarly titled measures used by other companies. Reconciliation from GAAP to non-GAAP results is included in the financial statements contained in this release.

The Company’s non-GAAP financial measures reflect adjustments based on the following items:

Stock-based compensation expense. These expenses primarily relate to employee stock options, employee stock purchase plans, and employee non-vested equity stock and non-vested stock units. The Company excludes stock-based compensation expense from its non-GAAP measures primarily because such expenses are non-cash expenses that the Company does not believe are reflective of ongoing operating results. Additionally, given the fact that other companies may grant different amounts and types of equity awards and may use different option valuation assumptions, excluding stock-based compensation expense permits more accurate comparisons of the Company’s results with peer companies.

Acquisition-related costs and retention bonus expense. These expenses include all direct costs of certain acquisitions and the reported periods’ portion of any retention bonus expense associated with the acquisitions. The Company excludes these expenses in order to provide better comparability between periods as they are related to acquisitions and have no direct correlation to the Company’s operations.

Restructuring charges. These charges may consist of severance, contractual retention payments, exit costs and other charges and are excluded because such charges are not directly related to ongoing business results and do not reflect expected future operating expenses.

Impairment of assets held for sale. These charges consist of non-cash charges to assets held for sale and are excluded because such charges are non-recurring and do not reduce the Company’s liquidity.

Amortization expense. The Company incurs expenses for the amortization of intangible assets acquired in acquisitions. The Company excludes these items because these expenses are not reflective of ongoing operating results in the period incurred. These amounts arise from the Company’s prior acquisitions and have no direct correlation to the operation of the Company’s core business.

Escrow settlement refund. The Company received a refund from an escrow settlement related to a prior acquisition. The Company excludes these items because these receipts are not reflective of ongoing operating results. These amounts arise from the Company’s prior acquisitions and have no direct correlation to the operation of the Company’s core business.

Non-cash interest expense on convertible notes. The Company incurs non-cash interest expense related to its convertible notes. The Company excludes non-cash interest expense related to its convertible notes to provide more accurate comparisons of the Company’s results with other peer companies and to more accurately reflect the Company’s ongoing operations.

Income tax adjustments. For purposes of internal forecasting, planning and analyzing future periods that assume net income from operations, the Company estimates a fixed, long-term projected tax rate of approximately 24 percent for both 2020 and 2019, which consists of estimated U.S. federal and state tax rates, and excludes tax rates associated with certain items such as withholding tax, tax credits, deferred tax asset valuation allowance and the release of any deferred tax asset valuation allowance. Accordingly, the Company has applied these tax rates to its non-GAAP financial results for all periods in the relevant years to assist the Company’s planning.

On occasion in the future, there may be other items, such as significant gains or losses from contingencies that the Company may exclude in deriving its non-GAAP financial measures if it believes that doing so is consistent with the goal of providing useful information to investors and management.

Forward-Looking Statements

This release contains forward-looking statements under the Private Securities Litigation Reform Act of 1995, including those relating to Rambus’ expectations regarding operating results and business opportunities, growth in product and service offerings and product revenue, expected benefits of our merger, acquisition and divestiture activity and related integration, and financial guidance for the third quarter of 2020, including licensing billings and revenue estimates, operating costs and expenses, interest and other income (expense), net and estimated, fixed, long-term projected tax rates on a GAAP and non-GAAP basis, as appropriate. Such forward-looking statements are based on current expectations, estimates and projections, management’s beliefs and certain assumptions made by Rambus’ management. Actual results may differ materially. Rambus’ business generally is subject to a number of risks which are described more fully in Rambus’ periodic reports filed with the Securities and Exchange Commission, as well as the potential adverse impacts related to, or arising from, the Novel Coronavirus (COVID-19). Rambus undertakes no obligation to update forward-looking statements to reflect events or circumstances after the date hereof.

Contact:

Rahul Mathur

Senior Vice President, Finance and Chief Financial Officer

Rambus Inc.

(408) 462-8000

[email protected]

Rambus Inc.

Condensed Consolidated Balance Sheets

(In thousands)

(Unaudited)

| June 30, 2020 |

December 31, 2019 |

||||||

| ASSETS | |||||||

| Current assets: | |||||||

| Cash and cash equivalents | $103,275 | $102,176 | |||||

| Marketable securities | 382,802 | 305,488 | |||||

| Accounts receivable | 35,198 | 44,039 | |||||

| Unbilled receivables | 155,448 | 184,366 | |||||

| Inventories | 11,554 | 10,086 | |||||

| Prepaids and other current assets | 17,970 | 18,524 | |||||

| Total current assets | 706,247 | 664,679 | |||||

| Intangible assets, net | 45,624 | 54,900 | |||||

| Goodwill | 183,222 | 183,465 | |||||

| Property, plant and equipment, net | 50,858 | 44,714 | |||||

| Operating lease right-of-use assets | 31,407 | 37,020 | |||||

| Deferred tax assets | 5,350 | 4,574 | |||||

| Unbilled receivables, long-term | 289,044 | 343,703 | |||||

| Other assets | 4,895 | 5,931 | |||||

| Total assets | $1,316,647 | $1,338,986 | |||||

| LIABILITIES & STOCKHOLDERS’ EQUITY | |||||||

| Current liabilities: | |||||||

| Accounts payable | $14,016 | $9,549 | |||||

| Accrued salaries and benefits | 16,170 | 20,291 | |||||

| Deferred revenue | 10,841 | 11,947 | |||||

| Income taxes payable, short-term | 20,044 | 19,142 | |||||

| Operating lease liabilities | 4,463 | 6,357 | |||||

| Other current liabilities | 17,924 | 18,893 | |||||

| Total current liabilities | 83,458 | 86,179 | |||||

| Long-term liabilities: | |||||||

| Convertible notes, long-term | 152,359 | 148,788 | |||||

| Long-term operating lease liabilities | 37,626 | 39,889 | |||||

| Long-term income taxes payable | 50,472 | 60,094 | |||||

| Deferred tax liabilities | 14,724 | 13,846 | |||||

| Other long-term liabilities | 12,818 | 19,272 | |||||

| Total long-term liabilities | 267,999 | 281,889 | |||||

| Total stockholders’ equity | 965,190 | 970,918 | |||||

| Total liabilities and stockholders’ equity | $1,316,647 | $1,338,986 | |||||

Rambus Inc.

Condensed Consolidated Statements of Operations

(In thousands, except per share amounts)

(Unaudited)

| Three Months Ended June 30, |

Six Months Ended June 30, |

||||||||||||||

| 2020 | 2019 | 2020 | 2019 | ||||||||||||

| Revenue: | |||||||||||||||

| Royalties | $16,957 | $27,050 | $36,651 | $51,903 | |||||||||||

| Product revenue | 31,725 | 16,031 | 62,453 | 24,995 | |||||||||||

| Contract and other revenue | 11,248 | 15,216 | 24,815 | 29,783 | |||||||||||

| Total revenue | 59,930 | 58,297 | 123,919 | 106,681 | |||||||||||

| Cost of revenue: | |||||||||||||||

| Cost of product revenue (1) | 10,277 | 6,310 | 20,620 | 10,737 | |||||||||||

| Cost of contract and other revenue | 1,535 | 2,910 | 2,733 | 5,818 | |||||||||||

| Amortization of acquired intangible assets | 4,336 | 3,807 | 8,680 | 7,670 | |||||||||||

| Total cost of revenue | 16,148 | 13,027 | 32,033 | 24,225 | |||||||||||

| Gross profit | 43,782 | 45,270 | 91,886 | 82,456 | |||||||||||

| Operating expenses: | |||||||||||||||

| Research and development (1) | 34,688 | 37,890 | 71,352 | 78,509 | |||||||||||

| Sales, general and administrative (1) | 21,310 | 23,794 | 44,205 | 50,314 | |||||||||||

| Amortization of acquired intangible assets | 248 | 1,114 | 596 | 2,239 | |||||||||||

| Restructuring charges | — | 2,528 | 836 | 2,859 | |||||||||||

| Change in fair value of earn-out liability | — | — | (1,800) | — | |||||||||||

| Impairment of assets held for sale | — | 16,990 | — | 16,990 | |||||||||||

| Total operating expenses | 56,246 | 82,316 | 115,189 | 150,911 | |||||||||||

| Operating loss | (12,464) | (37,046) | (23,303) | (68,455) | |||||||||||

| Interest income and other income (expense), net | 4,597 | 6,972 | 10,971 | 14,385 | |||||||||||

| Interest expense | (2,580) | (2,534) | (5,135) | (4,805) | |||||||||||

| Interest and other income (expense), net | 2,017 | 4,438 | 5,836 | 9,580 | |||||||||||

| Loss before income taxes | (10,447) | (32,608) | (17,467) | (58,875) | |||||||||||

| Provision for income taxes | 334 | 4,372 | 1,297 | 4,681 | |||||||||||

| Net loss | $(10,781) | $(36,980) | $(18,764) | $(63,556) | |||||||||||

| Net loss per share: | |||||||||||||||

| Basic | $(0.09) | $(0.33) | $(0.17) | $(0.58) | |||||||||||

| Diluted | $(0.09) | $(0.33) | $(0.17) | $(0.58) | |||||||||||

| Weighted average shares used in per share calculation | |||||||||||||||

| Basic | 113,572 | 110,875 | 113,240 | 110,287 | |||||||||||

| Diluted | 113,572 | 110,875 | 113,240 | 110,287 | |||||||||||

_________

(1) Total stock-based compensation expense for the three and six months ended June 30, 2020 and 2019 is presented as follows:

| Three Months Ended June 30, | Six Months Ended June 30, |

||||||||||||||

| 2020 | 2019 | 2020 | 2019 | ||||||||||||

| Cost of product revenue | $— | $1 | $— | $2 | |||||||||||

| Research and development | $2,515 | $3,058 | $5,128 | $6,268 | |||||||||||

| Sales, general and administrative | $4,192 | $4,021 | $7,651 | $7,999 | |||||||||||

Rambus Inc.

Supplemental Reconciliation of GAAP to Non-GAAP Results

(In thousands)

(Unaudited)

|

Three Months Ended June 30, |

|||||||

| 2020 | 2019 | ||||||

| Total operating expenses | $56,246 | $82,316 | |||||

| Adjustments: | |||||||

| Stock-based compensation expense | (6,707) | (7,080) | |||||

| Acquisition-related costs and retention bonus expense | (1,577) | — | |||||

| Amortization of acquired intangible assets | (248) | (1,114) | |||||

| Restructuring charges | — | (2,528) | |||||

| Impairment of assets held for sale | — | (16,990) | |||||

| Escrow settlement refund | — | 296 | |||||

| Non-GAAP total operating expenses | $47,714 | $54,900 | |||||

| Interest and other income (expense), net | $2,017 | $4,438 | |||||

| Adjustments: | |||||||

| Interest income related to significant financing component from fixed-fee patent and technology licensing arrangements | (3,697) | (5,288) | |||||

| Non-cash interest expense on convertible notes | 1,798 | 1,702 | |||||

| Non-GAAP interest and other income (expense), net | $118 | $852 | |||||

Rambus Inc.

Reconciliation of GAAP Forward Looking Estimates to Non-GAAP Forward Looking Estimates

(In millions)

(Unaudited)

| 2020 Third Quarter Outlook | Three Months Ended September 30, 2020 | ||||||

| Low | High | ||||||

| Forward-looking operating costs and expenses | $75.6 | $71.6 | |||||

| Adjustments: | |||||||

| Stock-based compensation expense | (7.0) | (7.0) | |||||

| Amortization of acquired intangible assets

|

(4.5) | (4.5) | |||||

| Forward-looking Non-GAAP operating costs and expenses | $64.1 | $60.1 | |||||

| Forward-looking interest and other income (expense), net | $1.7 | $1.7 | |||||

| Adjustments: | |||||||

| Interest income related to significant financing component from fixed-fee patent and technology licensing arrangements | (3.3) | (3.3) | |||||

| Non-cash interest expense on convertible notes | 1.8 | 1.8 | |||||

| Forward-looking Non-GAAP interest and other income (expense), net | $0.2 | $0.2 | |||||